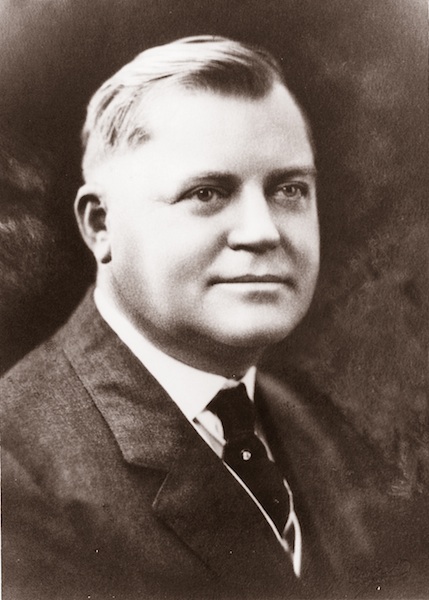

The story goes that back in the early 1900s, when workers were being paid with gold and signed warrants by marking an X, the railroad station agent in Pinole would go on a day-long, dangerous trip to Martinez to get their payment. That station agent was E. M. Downer, who created the Bank of Pinole. In 1907, he merged it with a financial institution in Richmond that soon was called the Mechanics Bank.

“He wasn’t wealthy, but he was an entrepreneur and a charismatic man,” said Rauly Butler, the bank’s current senior vice president.

Today, four generations later, Downer’s enterprise remains locally owned and a family majority-owned business. It kept its original name and it’s still a community bank. It’s Richmond’s oldest bank and the only one currently headquartered in Richmond, although it now has branches all around the Contra Costa County and in seven neighboring counties in northern California.

At the end of last year, the Mechanics Bank had 670 employees; 42,977 personal banking clients and 9,664 business banking clients.

The life, survival and success of the Mechanics Bank is closely tied to the history of Richmond, its hometown. During its early years, the Mechanics Bank was a place for local railroad workers in West Contra Costa County to cash their paychecks. These workers were called “mechanics” and that’s the reason for the bank’s name.

The bank lent money so people could buy appliances such as refrigerators and freezers. “At that time, banks were not for the regular person,” said Butler. “Banks were known for lending money to businesses.” The Mechanics Bank was the first bank in the region to give personal loans. “Starting a bank for the mechanics — are you kidding? That was very unusual,” said Butler.

But the bank served local businesses, too. During the 1920s, Richmond was a West Coast industrial center, home to major facilities for Standard Oil, the Santa Fe Railroad and the Ford Motor Company. The bank provided financial services for the corporations and their employees.

Butler said that during the Great Depression, the bank survived a time of massive bank failures around the nation because of the support of Standard Oil, the City of Richmond and Richmond’s newspaper. The leaders of these organizations let the community know that they had full faith in the Mechanics Bank and were keeping their money in it, which encouraged people to trust the bank, said Butler.

In the 1940s, World War II brought local prosperity to Richmond. The city became the home of Kaiser Shipbuilding and with the shipyards 70,000 new residents arrived. The Mechanics Bank’s assets quadrupled from 1941 to 1945, becoming a major financial force in the East Bay.

But once the war ended, the shipyard workers were no longer needed, leaving tens of thousands unemployed. According to Butler, the bank made public through the newspaper that no homeowner would lose his house, and worked with borrowers to avoid foreclosure. The community helped the bank during the Depression years, so “the bank returned the favor,” Butler said.

During the 1990s, the bank expanded beyond West Contra Costa County for the first time, opening offices in Alameda, Marin, Napa, San Francisco and Sacramento counties.

Today, after the 2008 financial crisis, the Mechanics Bank is still in business. “We didn’t need to take TARP money,” Butler said, but acknowledged that the recession had an impact on the bank. “Interest rates are low and that affects every bank.”

As a community bank, the Mechanics Bank focuses on loaning money to local individuals and businesses. According to Butler, it didn’t need follow the trend of securitization of real estate mortgages to remain competitive in the stock market “If we would have done that, we would be out of business today,” he said.

Even the charitable donations Mechanics Bank makes stay in the community. “They volunteer in our special events, and help us with fundraising. They are significant financial sponsors and provide a myriad of bank services,” said Rev. John Anderson, President of the Bay Area Rescue Mission, a non-profit that helps the homeless and impoverished in Richmond. Anderson said that the Mechanics Bank was involved helping the non-profit since it began 45 years ago.

Decisions on how to manage the bank are still controlled by the Downer family. Early this month, E.M. Downer’s great-granddaughter, Dianne Daiss Felton, began serving as chairman of the board. Michael Downer, a great-grandson, serves as vice chairman.

The bank prides itself on personable service, particularly its non-automated 800 number. “I love it. When you call, you get an actual person that helps you,” said customer Joshua Gutierrez.

Customer Tina Scott, who works near the bank’s Point Richmond office, said that when the line is too long, the manager will take her deposit and personally bring the receipt to her work. “All the employees are very nice,” she said.

The bank’s involvement with non-profits and record of reciprocity with the community hasn’t gone unnoticed. Last December, the Move Your Money campaign started encouraging people to transfer their funds from big banks to credit unions or community banks. Their site provides a link to a zip code look-up service to help consumers find “risk free” community banks. The Mechanics Bank pops on the list of recommended institutions.

Butler says that Richmond’s oldest bank is still growing; this year the number of people opening new accounts at the Mechanics Bank has doubled. “I’m very proud of what the Bank does for the community, the customers’ trust and the financial stability offered,” Butler said.

May 28, 2010 Richmond Confidential